After a challenging April, the U.S. stock market made a notable rebound today as Wall Street surged, pushing the S&P 500 index to within striking distance of its all-time high. The strong performance comes as a relief to investors who weathered a turbulent month, with concerns ranging from inflation worries to geopolitical tensions.

The S&P 500, a broad measure of the U.S. equities market, saw a significant uptick, climbing to within just 1% of its record high. This rebound signals renewed optimism among investors, bolstered by positive economic indicators and corporate earnings reports.

One of the key drivers behind today’s rally is the renewed confidence in economic recovery. With vaccination rates rising and lockdown measures easing in many parts of the country, there is growing anticipation of a robust rebound in consumer spending and business activity. This optimism is reflected in the performance of sectors such as consumer discretionary, technology, and financials, which posted strong gains today.

Additionally, corporate earnings have been surpassing expectations, providing further support for the market rally. Many companies have reported stellar earnings for the first quarter, underscoring the resilience of the U.S. economy despite lingering challenges. These positive earnings reports have helped to allay concerns about lofty valuations and provide justification for current stock prices.

Furthermore, the Federal Reserve’s commitment to maintaining accommodative monetary policy has provided a tailwind for equities. The central bank has reiterated its stance that it will keep interest rates near zero and continue its asset purchase program until substantial progress is made in achieving its employment and inflation goals. This commitment to support the economy has been a reassuring factor for investors, fueling risk appetite and driving capital flows into the stock market.

However, despite today’s gains, there are still lingering uncertainties that could potentially weigh on market sentiment in the near term. Inflation remains a key concern, as signs of price pressures have emerged in recent months. While the Fed has downplayed inflationary risks as transitory, any unexpected uptick in inflation data could prompt a reassessment of monetary policy and lead to market volatility.

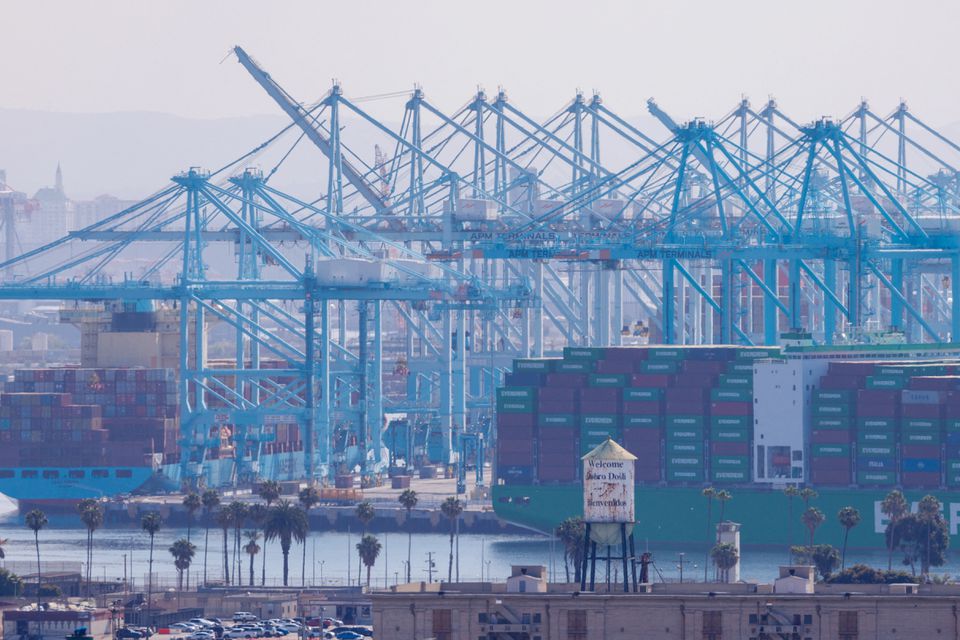

Geopolitical tensions also pose a potential risk to market stability. Ongoing conflicts and diplomatic tensions around the world, particularly between the U.S. and China, could escalate and disrupt global trade and supply chains, impacting corporate earnings and investor confidence.

In summary, today’s rally on Wall Street reflects renewed optimism and confidence in the economic recovery, supported by positive earnings reports and accommodative monetary policy. While challenges and uncertainties remain, investors are cautiously optimistic about the market’s prospects in the months ahead as the U.S. economy continues its path towards recovery.