Inflation may have decelerated in the latter part of last year, but its impact on American households was profound and far-reaching. According to recent data released by the Federal Reserve, nearly two-thirds of U.S. adults, approximately 65%, experienced a decline in their financial well-being due to rising prices. The ripple effects of inflation were not merely inconvenient but, in many cases, devastating.

The Scope of Financial Hardship

The Federal Reserve’s report sheds light on the stark reality faced by millions of Americans. While the pace of inflation showed signs of slowing, the cost of living remained elevated across essential categories such as food, housing, and healthcare. For many households, this meant difficult choices and tightened budgets. The data indicates that roughly 1 in 6 Americans, or about 16.7%, found themselves unable to cover all their monthly bills.

Essential Expenses Under Pressure

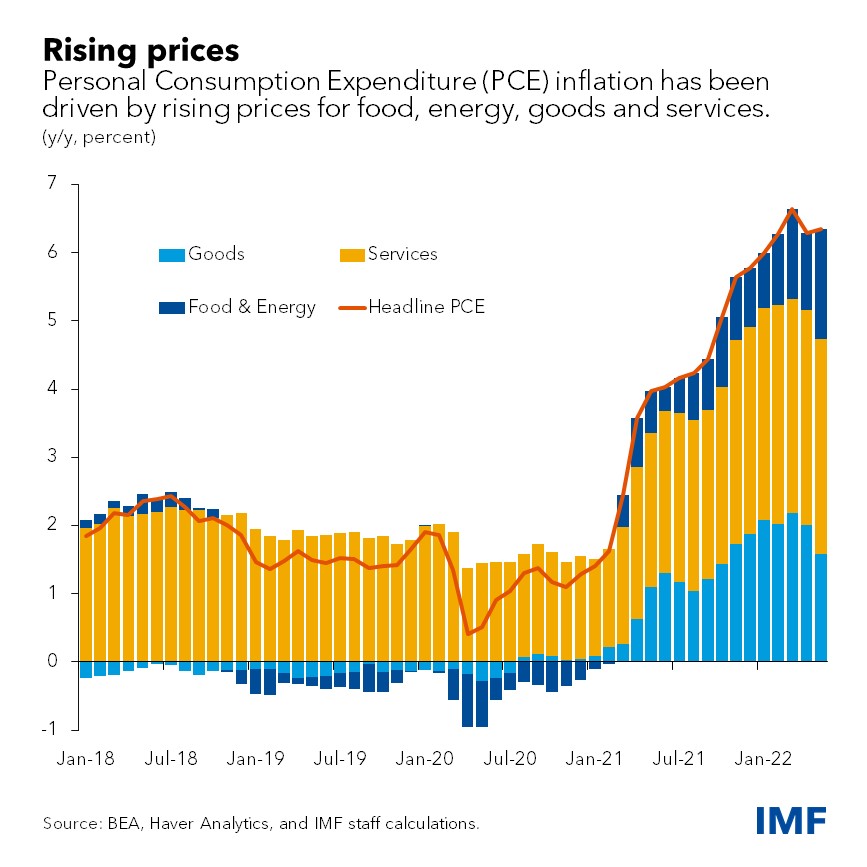

The primary drivers behind this financial strain were surging costs in areas that constitute the bulk of household expenditures. Grocery bills soared, rent and mortgage payments climbed, and healthcare expenses increased, stretching family budgets to their limits. This persistent pressure eroded savings and forced many to dip into emergency funds or accumulate debt, further compromising their financial stability.

Broader Economic Implications

The repercussions of high inflation are not confined to individual households but extend to the broader economy. When a significant portion of the population struggles to meet basic expenses, consumer spending — a key driver of economic growth — is curtailed. This reduction in spending can slow economic recovery, creating a feedback loop that exacerbates financial difficulties for many.

The Federal Reserve’s Role

The Federal Reserve has been actively working to manage inflation through monetary policy adjustments. Interest rate hikes have been one tool employed to cool down the overheated economy. However, the lag between policy implementation and tangible effects means that many Americans continued to feel the pinch throughout the year.

Policy Responses and Relief Measures

In response to the financial challenges posed by inflation, various government programs have been designed to provide relief. Stimulus checks, enhanced unemployment benefits, and other forms of financial aid were introduced to help mitigate the impact. However, these measures often provided only temporary respite and were not enough to fully offset the sustained rise in living costs.

Looking Ahead

While there are signs that inflationary pressures may continue to ease, the economic scars left by the past year will take time to heal. Policymakers are tasked with balancing efforts to control inflation while fostering economic growth and supporting those most affected by the financial upheaval.

For millions of Americans, the lingering effects of high inflation will shape financial decisions and stability for the foreseeable future. The Federal Reserve’s data serves as a sobering reminder of the profound impact economic conditions can have on everyday lives and underscores the importance of vigilant economic policy and support systems.

In conclusion, the story of high inflation in the past year is one of widespread financial strain and hardship. As nearly two-thirds of U.S. adults grapple with worsened finances, the nation must continue to address the root causes and provide robust support to those struggling to make ends meet.