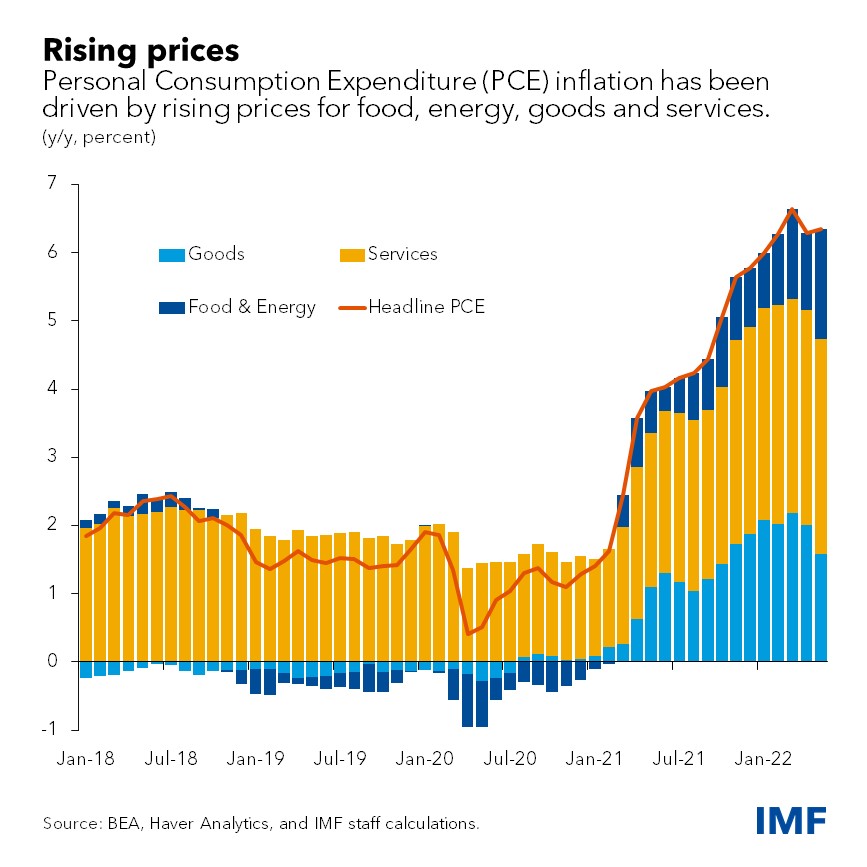

The latest data release from the Commerce Department suggests a subtle easing in the pace of inflation, providing some respite for economists and policymakers concerned about rising price pressures. The report, which highlights the Federal Reserve’s preferred inflation gauge, the core Personal Consumption Expenditures (PCE) index, indicates a marginal deceleration in the rate of price increases for the 12 months ending in September. Excluding volatile gas and food prices, the core PCE index rose by 3.7%, a slight decrease from the 3.8% rate witnessed in the preceding month of August. Notably, this marks the smallest year-over-year increase since May 2021, when the rate stood at 3.2%.

On a monthly basis, the core PCE index demonstrated a more pronounced increase, rising by 0.3% in September, in contrast to the 0.1% rate recorded in August. While this month-on-month growth indicates a potential uptick in consumer spending, it also underscores the persistent challenges the Federal Reserve continues to grapple with as it navigates the delicate balance between stimulating economic growth and curbing inflationary pressures.

The tempered pace of inflation offers a glimmer of hope for businesses and consumers, who have been contending with elevated price levels across various sectors. Nevertheless, concerns remain regarding the broader implications of sustained inflation on purchasing power, consumer sentiment, and overall economic stability. As the Federal Reserve continues to assess economic indicators and deliberates on appropriate policy responses, market participants and analysts alike await further insights into the central bank’s strategies for managing inflation in the months ahead.

Economists emphasize the importance of continued vigilance in monitoring key economic data points to discern the trajectory of inflation, considering its potential implications for interest rates, investment decisions, and overall market dynamics. As the global economy navigates the intricate post-pandemic recovery, the nuanced interplay between inflation dynamics, supply chain disruptions, and evolving consumer behavior remains pivotal in shaping future monetary policies and economic outlooks.

The latest inflation report, while reflecting a minor deceleration, underscores the ongoing need for proactive measures and a comprehensive understanding of the complex factors contributing to price fluctuations. As stakeholders across various sectors analyze the implications of the report, the trajectory of inflation will remain a central focal point in discussions shaping economic policy and market dynamics in the coming months.