As speculation mounts about potential interest rate cuts by the Federal Reserve in 2024, it is crucial to understand the conditions that might prompt such a monetary policy shift. Contrary to conventional expectations, interest rate reductions typically occur in response to economic challenges rather than during periods of prosperity. This article explores the factors that could lead the Federal Reserve to consider slashing interest rates in the coming year.

Economic Indicators:

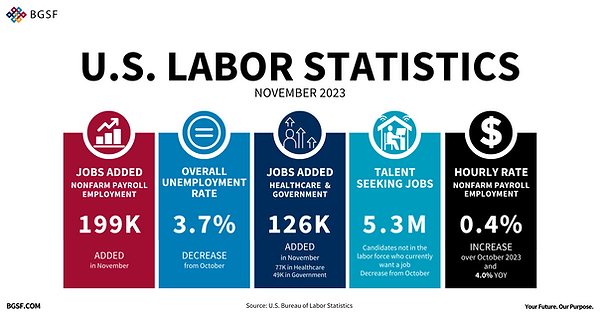

The Federal Reserve closely monitors key economic indicators, including GDP growth, unemployment rates, and inflation. If there are signs of a significant economic slowdown or contraction, it may prompt the Fed to consider lowering interest rates to stimulate economic activity.

Inflationary Pressures:

Inflation is a critical factor influencing monetary policy. The Federal Reserve aims for stable prices and may intervene if inflation deviates from its target. If inflationary pressures are deemed too low, the Fed might lower interest rates to encourage spending and investment.

Global Economic Conditions:

The interconnected nature of the global economy means that events beyond U.S. borders can impact domestic economic stability. A downturn in major economies or global financial instability could lead the Fed to implement interest rate cuts as a preemptive measure.

Market Volatility:

Financial markets often react to uncertainty, and increased volatility can have ripple effects on the broader economy. The Federal Reserve may respond to turbulent market conditions by lowering interest rates to provide a stabilizing influence.

Employment Trends:

The labor market plays a significant role in the Fed’s decision-making process. Persistent high unemployment or signs of a weakening job market might prompt the central bank to lower interest rates to spur job creation and economic growth.

Trade and Geopolitical Factors:

Trade tensions and geopolitical uncertainties can introduce risks to the economic outlook. The Federal Reserve may adjust interest rates in response to trade disputes or geopolitical events that threaten economic stability.

Conclusion:

While interest rate cuts are generally associated with economic downturns, the Federal Reserve’s decision-making is nuanced and multifaceted. As we approach 2024, market participants should remain vigilant in monitoring economic indicators, inflationary pressures, global conditions, and other factors that could influence the Federal Reserve’s stance on interest rates. The anticipation of easing measures underscores the delicate balance the Fed seeks to maintain in supporting economic growth while safeguarding against potential risks.